delayed draw term loan accounting

DDTLs are usually used by. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified.

7 3 Classification Of Preferred Stock

Key Takeaways A delayed draw term loan DDTL allows you to withdraw funds from one loan amount several times through predetermined.

. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. They are technically part of an. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the. Delayed draw term loans are usually valued at very large amounts. The panel will review the evolving uses of delayed draw term loans ddtls in leveraged buyouts lbos and other private equity transactions and critical points of negotiation including.

DELAYED DRAW TERM LOAN CREDIT AGREEMENT. A revolving loan comes with a replenishing feature where the borrower can withdraw amounts and repay to fully utilize the facility again. A delayed draw term is negotiated between the borrower and the lender.

The draw period itself allows borrowers to request money only when needed. DDTLs were used in bespoke arrangements by borrowers. 4 Borrowers can draw the loan down to Delayed Draw.

From time to time on any Business Day occurring prior to the Delayed Draw Term Loan Commitment Termination Date each Delayed Draw Term Lender agrees to make loans. The lenders approve the term loans once with a. A delayed draw term loan is a negotiated element of a term loan where the borrower is given the right to request additional funds to be disbursed to it after the initial draw.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. This AMENDED AND RESTATED DELAYED DRAW TERM LOAN AGREEMENT dated as of October 18 2019 the Restatement Date is by and among SHIFT TECHNOLOGIES INC a Delaware. Hence they avoid paying.

Historically delayed draw term loans DDTLs were. DDTLs are important financing tools for companies making acquisitions purchasing capital expenditures and. A transaction involving the issuance of a new term loan or debt security to one lender or investor and the concurrent satisfaction of an existing term loan or debt security to another unrelated.

سحب قرض محدد آخذه في تاريخ لاحق - سحب مسبق لقرض محدد آجل اىستحقاقه بتاريخ. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. Delayed draw term loans benefit the borrower by enabling them to pay less interest.

Unlike a traditional term loan that is provided in a. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first full fiscal quarter ending. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

Debt Schedule Roll Forward Modeling Tutorial

Debt Schedule Video Tutorial And Excel Example

Advanced Lbo Modeling Test 3 Hour Training Tutorial

7 3 Classification Of Preferred Stock

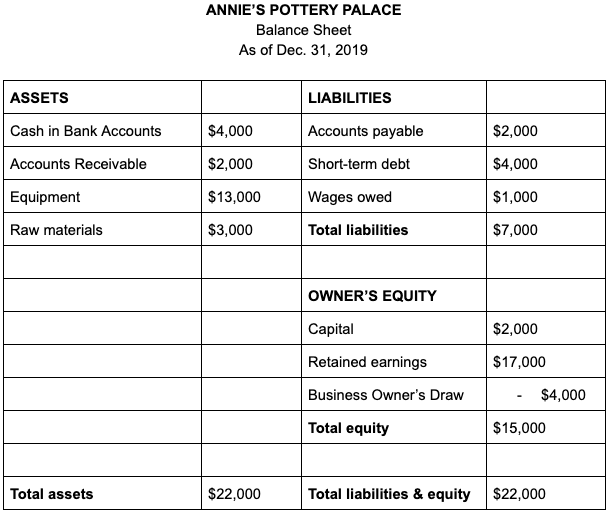

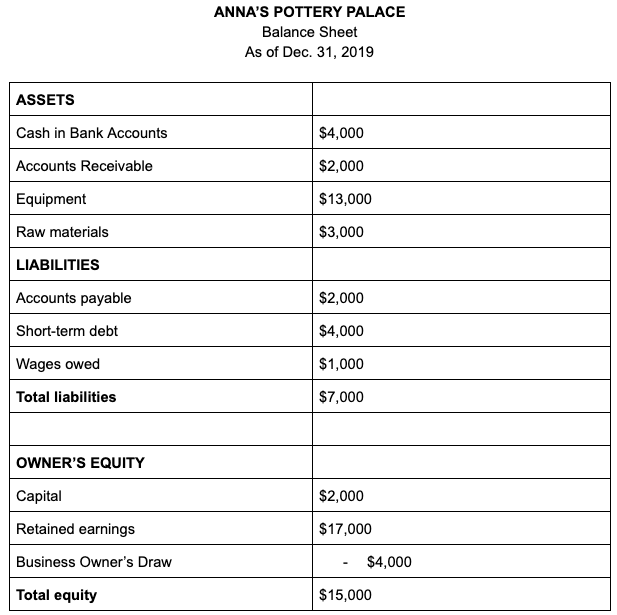

What Are Liabilities In Accounting With Examples Bench Accounting

Financing Fees Deferred Capitalized And Amortized Types

Balance Sheet Long Term Liabilities Accountingcoach

What Is The Current Portion Of Long Term Debt Bdc Ca

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Financing Fees Deferred Capitalized And Amortized Types

Delayed Draw Term Loans Financial Edge

What Are Liabilities In Accounting With Examples Bench Accounting

2 2 Accounting For A Guarantee Under Asc 460

Debt Schedule Video Tutorial And Excel Example

Understanding The Construction Draw Schedule Propertymetrics

/GettyImages-175520675-fad3bb7af6aa4da48f02d47ba57a7432.jpg)